Topic: Finance and debt

Deep funding cuts disrupting global health services, warns WHO

News / 5th February 2026Deep funding cuts forced significant workforce reductions and abrupt declines in bilateral aid triggered major disruptions to health systems and essential services across many countries in 2025.

US government slashes humanitarian aid pledge as cuts kill hundreds of thousands globally

News / 6th January 2026Research estimates that the destruction of USAID has killed hundreds of thousands of people across the globe—and could kill millions more in the coming years.

The G20 has failed on debt. Time to look to the UN

Blog / 27th November 2025If we want to find fair solutions to the debt problems that plague Global South countries, forums like the G20 won't deliver. It's time to establish a UN sovereign debt resolution mechanism, long demanded by G77 countries.

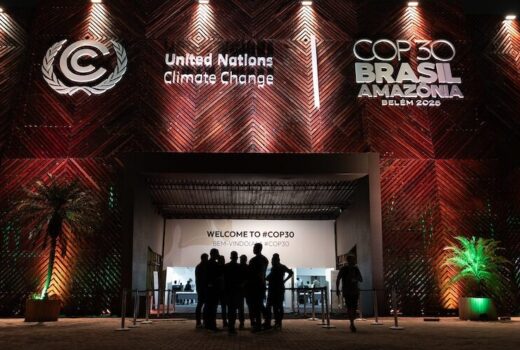

At COP30, progress on public finance is critical for a fair fossil fuel phaseout

Blog / 19th November 2025Nearing the final COP30 sprint, the world must move from words to action: by ending fossil fuel expansion and unlocking finance for a fair, fast and funded energy transition.

US and European aid cuts could result in 22.6 million deaths worldwide, study finds

News / 19th November 2025Abrupt cuts to development aid by major donor countries could cause up to 22.6 million additional deaths in developing countries by 2030, according to a new study.

Urgent calls for debt relief as study shows health and education cuts in developing world

News / 13th October 2025Top economists are demanding urgent action on debt relief as analysis from the campaign group Debt Justice shows struggling governments are cutting back on health and education.

Global health at risk as funding cuts threaten fight against AIDS, TB, and malaria

News / 9th October 2025Global efforts to fight three of the world's most harmful and widespread infectious diseases—AIDS, tuberculosis, and malaria—are now threatened by dramatic cuts to global health financing.

UN’s humanitarian work is ‘underfunded, overstretched, and under attack

News / 19th September 2025“Underfunded, overstretched and under attack” is how the UN's top aid official has referred to the UN and the support it is providing to the humanitarian sector.

Rich countries meet only 4% of funds East Africa needs to address climate change

Report / 8th September 2025Rich countries have broken their climate finance promises to a key grouping of eight highly vulnerable African countries, according to new research from Oxfam.

UN’s lifesaving programmes under threat as budget crisis hits hard

News / 5th June 2025The UN is facing a deepening budget crisis that threatens lifesaving operations worldwide. From refugee aid in Mozambique to maternal health services in Afghanistan, critical programmes are on the brink of collapse unless urgent funding is secured.